Part 5 – Six Elements of Project Controls –Proof of Value

By Lance Stephenson, CCP FAACE Hon. Life

Lance Stephenson, CCP FAACE Hon. Life, is a contributing member of AACE’s Technical Board and is a Certified Cost Professional. Lance has provided direction in the areas of organizational design, process improvements, auditing, maturity assessments, and the development and implementation for improved capital portfolio and project effectiveness. He is a senior leader and manager with over 35 years of experience in the operational, capital portfolio, and project delivery environment and is currently the Director of Operations for AECOM.

Links to parts 1 thru 4:

Part 1 – Six Elements of Project Controls – The Basics

Part 2 – Six Elements of Project Controls – Quality

Part 3 – Six Elements of Project Controls – Maturity

Part 4 – Six Elements of Project Controls – Competency and Level of Effort

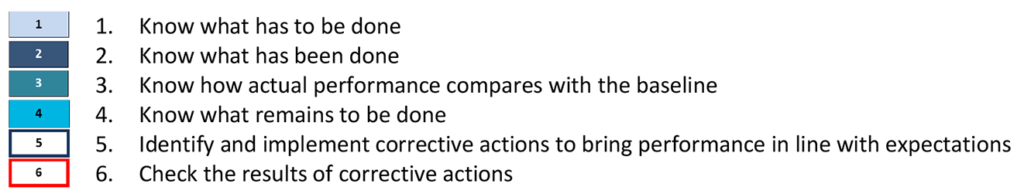

This article continues the series on the Six Elements of Project Controls. Past articles included the basics of the six elements of project controls, the effect of quality, the maturity required, defined competencies, and the level of effort. Today’s article discusses the value of introducing and managing the six elements of project controls within your organization. The six elements include the following:

The six elements of project controls are the operational steps for managing functional project control requirements within a project. As discussed in earlier articles, knowing about these elements is not enough; it is essential to know why they need to be applied to fully comprehend the value these efforts provide. The following case study provides the required context for further comprehending their criticality.

Case Study – Interconnecting Piping System Project

A project was required to improve the throughput of an interconnecting piping system to an existing pipeline facility.

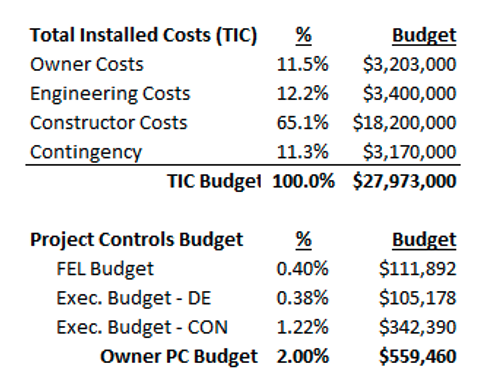

- The project’s total installed cost (TIC) was estimated at $27.97 MM.

- Contingency was set at $3.17 MM.

- The TIC for the project included all front-end loading (FEL), execution, and commissioning/startup costs.

- The Front-End Loading (FEL) phases were estimated to take eight months to

- Detailed engineering (six months).

- Construction (ten months).

The project had an aggressive finish date as it had to align with the shipper’s shutdown date (to connect to their oil refining facility); a one-month schedule buffer was added to the overall duration to ensure that the in-service date would be met. The project was highly complex, with numerous significant risks identified due to the large number of underground work and connection points. Much above-groundwork was also required, so coordination efforts were critical for success. Due to the complexity and aggressive finish date, it was determined that time and material (T&M) contracts would be required, and the owner would carry most of the project and financial risks. The construction portion of the project was competitively bid, where a target estimate was determined.

Because of these requirements and subsequent concerns, it was decided that a more experienced project controls team would be required to provide the proper governance and oversight to manage the risks and, subsequently, the execution of the project. The total owner project controls budget was then set at $559.5 K (2% of TIC) of which $111.9 K was allocated to manage the FEL phases and $447.6 K was used to manage the execution portion of the project (detail engineering, procurement, and construction). The contractor was required to assign dedicated, experienced project control personnel funded within their respective contract. Table 1 illustrates the budget elements for the project per phase, including a breakdown of the owner project controls budget.

Table 1 – Project Controls Budget for the Interconnect Piping System Project

The project progressed smoothly through the FEL phases with no substantial cost increase or delay in meeting the required in-service date. The detail-design portion of the execution phase also experienced minimal issues; the design intent was maintained. With everything going according to schedule and budget, the project manager (and his senior manager) cut the budget for the owner’s field project control staff as they didn’t see the value of having a field project control presence. The owner project controls budget for field activities was estimated at $342.4 K. This budget was required to provide governance, oversight, and risk management for contractor activities while providing overall project administrative/controls duties for the owner project manager and team. Even though eliminating the owner project controls effort was highly contested, the decision was not overturned. Because of this budget cut, the project controls manager requested that his team validate the schedule, resource requirements, and progress measurement (earning rules) to ensure a robust plan was in place. This request was also denied.

Construction activities started on time as planned, and as the construction activities progressed, the contractor provided construction reports on the work activities. The contractor did assign a project coordinator to complete the project controls deliverables as outlined in the contract; however, minimal reporting was introduced, and only a three-week look-ahead schedule was used. It was later determined that the project coordinator did not have the project controls skill set as defined in the contract, nor did the contractor comply with the requirements.

At the end of the sixth month of the 10-month construction schedule, it became apparent that the contractor and its subcontractors were experiencing performance and delay issues, which impacted both the costs and schedule of the construction activities. The senior manager, who enforced the decision not to have owner project controls oversight, asked for a team of project controls specialists to be assigned to complete an investigation and provide triage support as necessary. The triage efforts introduced allowed the project team to recover one month of the seven-month schedule delay and identify some improvements for a small reduction in the forecasted cost overrun.

Findings from the Investigation – The Dissection of Impacts

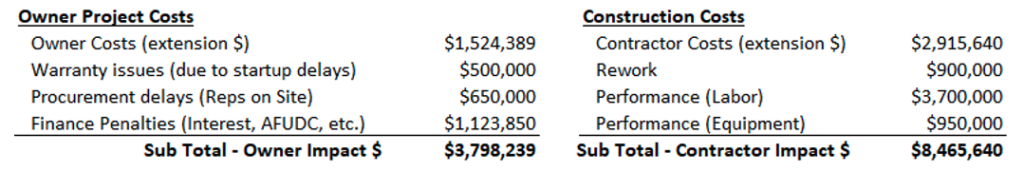

Upon project completion, a post-mortem[i] was completed. Table 2 represents the activities that contributed to the project cost impacts on the owner and constructor’s costs. The list provides the cost increases for owner costs as well as the construction costs. The most significant cost increase for the owner was due to the schedule extension. The extension to the schedule also contributed to increased construction costs; labor performance also contributed to the increase.

Table 2 – Post-mortem of Project Costs

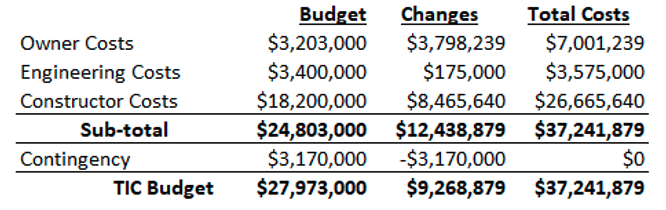

The contractor costs grew from an original budget of $18.20 MM to $26.67 MM, while the owner costs grew from $3.20 MM to $7.00 MM, as illustrated in Table 3. The owner project controls cost to complete the investigation and support the triage effort was $702,720, over twice the amount of the original budget of $342,390. With 100% of the contingency funds used to pay for some additional costs, the total project overrun came to $9.27 MM. The overrun was paid for out of the portfolio funds[ii] allocated for the fiscal period.

Table 3 – Variance of Project Costs by Participant

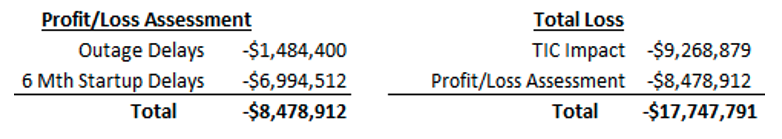

The more significant issue was the owner’s revenue and profit loss. Table 4 illustrates that the outage and schedule delays contributed to $8.48 MM in lost profits. The business cost[iii] overrun, including profit/loss, was $17.75 MM, 97.5% of the original construction costs ($18.2 MM).

Table 4 – Total Cost Impact

While the cost and schedule impacts on the project were quite evident, there was a negative ripple effect on the organization. The project’s estimated return on investment (ROI) was 28%, with a hurdle rate of 13.5%. The investment was expected to yield returns exceeding the minimum rate of 12% required to justify the risks and costs of spending capital dollars on the project. Unfortunately, once the project was completed, the post-mortem assessment determined the expected yield at 10.5%, which would have resulted in the project’s rejection.

Owner organizations need to be acutely aware of the mismanagement of costs and schedule durations, given it has a negative impact on the project’s return on investment (ROI) and internal rate of return (IRR). These cost impacts affect the organization’s bottom line. For instance, it may result in the cancelation of downstream projects as other funding streams (portfolio funding, OPEX, etc.) are being expended to correct struggling project(s). Unfortunately, owner project teams may not realize their contributions to the total impact of their project(s) and the impact they may have on the residual costs the organization is required to absorb. This lack of realization, as illustrated in this case study, can have an even more significant impact on the organization’s competitive advantage. Because of the cost impact, the owner company may have to increase its rate structure for moving products to absorb the losses of the project. This approach to increasing the rate structure is known as the death spiral[iv]. Increasing the rate structure could change the competitive landscape in which they operate and put their market share at risk (further enhancing the downward spiral).

While the focus of the case study has been on cost impacts and schedule delays, other critical issues were also identified. Due to the lack of planning efforts, a significant safety event occurred in which two laborers were injured. The contractor was required to install a concrete pony wall and elevated pump foundations in one of the work areas. Unfortunately, the installation of the pony wall restricted access to the area where tanks needed to be installed. This, along with the elevated pump foundations, further restricted the team from moving any construction equipment (backhoe with hydraulic breaker) into the work area. Therefore, laborers had to demolish the pony wall using jackhammers and hand tools. While jackhammering, a portion of the wall collapsed on the two laborers. One individual suffered a sprained wrist, while another individual broke his leg. This individual was caught between the fallen pony wall and the elevated pump foundation. This issue restricted the ability to evacuate the laborer to receive medical care, which could have potentially turned this into a catastrophic event had the injuries been much worse. If a proper schedule had been developed and validated, the project team would have been made aware of the sequencing required to install the tanks, build the pony wall, and construct the elevated pump foundations. While this event did not have a direct monetary impact on the contractor, it did, however, change their safety rating, disqualifying them from bidding on any future work.

Another impact that occurred was the erosion of team morale. The lack of accountability and responsibility to execute the work destroyed any trust among the team members. This created a silo mentality, which instituted the blame game. This further hindered collaboration, eliminating the ability to collectively solve any problems that occurred. While it is difficult to determine the cost impact of team morale, this did have a causal effect on quality, safety, and productivity.

The case study provided demonstrates a myriad of lessons learned opportunities. Based on the post-mortem assessment, many contributing factors were identified which resulted in cost overruns and schedule delays. A summary of contributing factors include:

- The contractor demonstrated competency in project controls during the pre-qualification phase but did not implement the processes/systems as contractually required, i.e., bait and switch!

- The contractor had identified that two on-site project controls specialists were assigned in their proposal but chose not to fill these positions. The contractor had delegated the project coordinator (having minimal training) to complete the project controls efforts. His lack of focus on project controls efforts compounded site issues, which included:

- Actual costs/hours were not collected correctly (missing information).

- No progress measurement or earned value management was implemented; therefore, performance assessments were not carried out.

- Developed 3-week look-ahead schedules in Excel (without logic) instead of CPM Schedules (with logic). CPM schedules provide a structured, logical, and analytical approach with the capability to depict dependencies, progress tracking, float, delays, and resource allocation.

- There was a lack of change management controls (the contractor did not identify changes to the scope of work until the last few weeks of the project). A claim of $350,000 was submitted after the contractor left the site. This limited the ability to forecast potential outcomes. The lack of change management controls resulted in the inability to accurately identify additional risks as well.

- There was a lack of risk management controls, where the risk register was not kept up to date. This eliminated the ability to administer and identify mitigation strategies and use contingency funding properly, further reducing the ability to forecast potential outcomes.

- The contractor never applied the required resourcing levels to maintain the execution of the scheduled activities. Without proper reporting, the project team could not identify the impact of the lack of full-time-equivalent (FTEs) craft resources required to complete the construction activities. A resource-loaded CPM schedule would have provided this foresight.

- A proper schedule would have identified access/egress issues; the contractor had excavated numerous areas to install underground pipe. The numerous open areas restricted teams from working in a systematic and efficient manner, creating performance, productivity, and safety issues.

- Construction delays also caused compounding performance issues and introduced additional undue risks to the project including:

- Overtime and work week extensions resulted in fatigue and morale issues (diminished productivity and performance).

- Parallel work zones created congestion and interface issues between craft crews.

- Quality and craftsmanship of the installation were reduced due to fatigue and rework.

- Fatigue, team morale, congestion, rework, and performance issues all contributed to an unsafe work environment. The contractor’s safety rating doubled.

Most of the attention of this case study demonstrates cost and schedule impacts absorbed by the owner, as a T&M contract was put in place. The T&M contract structure shifted liability to the owner, requiring them to provide increased contractor oversight; however, if a firm-price contract were chosen, the contractor would have been liable. The contractor would have absorbed most of the cost impact because of their lack of compliance and due diligence in executing the work.

Degree of Application

Some would state that the project provided in the case study was destined to fail because of the impact of upstream events, which affected the construction activities. However, the investigation determined that this statement would be untrue. The scope of work was well-defined prior to starting construction activities. This was substantiated by the fact that minimal scope changes were introduced during the FEL and detail-design phases of the project. The contractor did accuse the owner of having a terrible target estimate[v]. This claim was refuted as a third-party assessment concluded project costs were in the mid-to-high point range of historical and benchmarked data of similar projects. In fact, the production rates used to validate the estimate were higher than the contractor’s original bid estimate and their supporting historical data. The owner also applied $3.17 MM (11.3% of the TIC) for contingency based on a P70 ranking (70% probability of achieving the estimated costs).

From the investigation, it was determined that the contributing factor was the means and methods of execution, compounded by the lack of project controls (oversight), resulting in inhibited and diminished performance. Unfortunately, by not assigning the personnel as budgeted by both the owner and contractor, the project teams introduced layers of systemic risks[vi] to the project. The budget of the project controls personnel was the countermeasure to mitigate any cost and schedule impacts and assist in implementing corrective actions via re-planning efforts. If the project team had introduced the assigned resources, appropriate governance, oversight, control, and analysis would have been provided to determine the project’s health. This would have identified issues in advance where mitigation measures could have been introduced. While not all costs or delays would have been eliminated, the team would have been aware of them and instituted corrective actions to minimize their impact[vii].

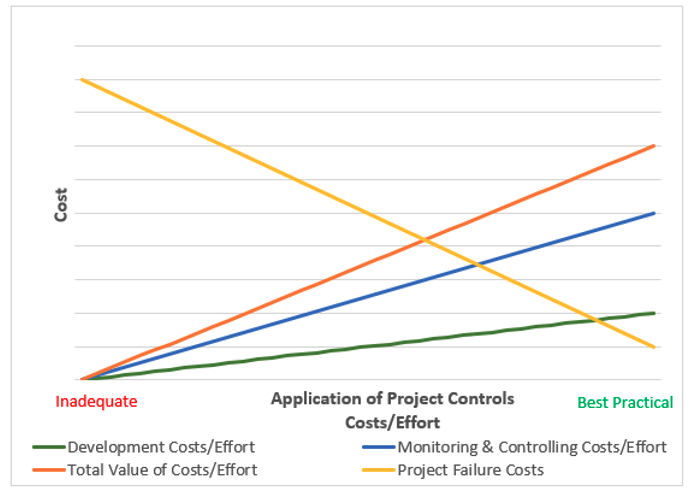

Numerous studies have been conducted indicating the application of project controls efforts can positively influence the project’s outcome. Organizations can establish the application of project controls by introducing both development costs/efforts and monitoring and controlling costs/efforts to drastically reduce project failure costs, as illustrated in Figure 1.

Figure 1 – Application of Project Controls Costs/Efforts

To understand the relationship between effort and reduction of failure costs, one must understand the individual efforts and their contributions. Each effort is driven by the same components: people, process, and technology, known as the PPT framework. Without the full complement of the PPT framework, the maturity of the efforts would not be realized, resulting in an increase in failure costs. The following further elaborates on this philosophy:

- Development effort is expended to prevent or avoid execution problems and enhance and optimize project delivery. The effort and subsequent costs are associated with designing and implementing the performance measurement baselines, which become the surveillance envelope. These deliverables are planned and incurred before the actual execution of the project or parts of the project.

- Monitor and control effort is associated with measuring and monitoring activities related to the project teams’ execution efforts. This is where surveillance begins and continues until the project closeout.

- Failure costs are incurred based on the influence of deliverable defects and lack of monitoring and control. These costs occur when the results of work fail to reach quality standards.

It must be noted that both development and monitoring/controlling efforts complement the best practical approach for instituting project controls. These efforts cannot be completed separately or in part. For instance, completing development efforts without monitoring and controlling the project does not ensure a favorable outcome. It’s equivalent to instituting laws without police officers or a judicial system to administer (monitor) and enforce (govern) them. On the flip side, you have nothing to monitor and control if you do not have the required deliverables developed. Worse yet, if you don’t have the skills (competency and capacity), you don’t know what or how to monitor and control the project. With this said, there is no opportunity to complete variance analysis to determine the impacts and institute course correction. Development efforts, complemented by monitoring and control efforts, go hand in hand. These efforts are effective barriers[viii] and act as an early warning system, eliminating factors causing project failure.

If the suggested efforts identified in this series of project control articles are implemented, organizations can significantly increase their chances for project success and minimize financial losses. On the other hand, if these efforts are not implemented, organizations will continue to introduce chaos and go down the path of failure. Your project control actions determine your success.

Proof of Value

The Value of Project Controls, as defined by the author, is the methodology that allows organizations to determine how much their resources are used for activities that enhance project delivery. This value is provided through the quality, maturity, competency, and level of effort of the organizations’ project control services. Project controls should never be considered a cost to a project; rather, they should be a value that contributes to positive outcomes, as demonstrated in the case study provided. Because the project team considered the project control effort as a cost (as illustrated in the case study), issues arose that contributed to the failure of this project. The decision to eliminate the field portion of the owner project controls team and the contractor’s lack of project controls compliance and skills impacted both parties. Both organizations experienced monetary, strategic, and reputational damage from this outcome. The contractor lost out on future work with the owner company because of their inability to provide the required personnel, and the owner project team was moved out of the organization due to their lack of judgment. Ultimately, this eroded trust and accountability, eliminating both organizations’ focus on value.

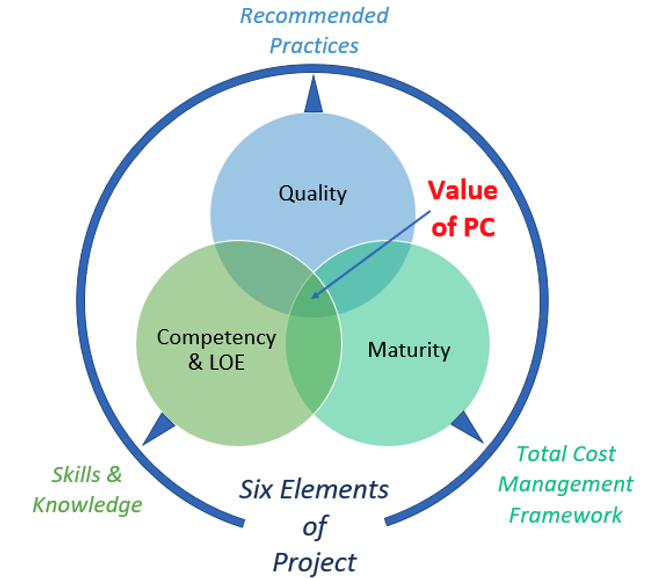

Figure 2 illustrates the association of the six elements in relation to the quality, maturity, competency, and level of effort components. These components can be further enhanced using credible, industry-based practices and standards, like AACE International’s TCM Framework, recommended practices (RPs), and skills and knowledge (S&K) study guides. Using these industry-recognized resources further increases organizations’ quality, maturity, and competency levels.

Figure 2 – Value of Project Controls

From earlier articles, it’s been discussed that an organization’s success is greatly enhanced if quality, maturity, and competency measures are implemented. Based on the case study provided, it is equally important to comply with these requirements. Proof of value is difficult to justify if these measures are not applied. The contractor and owner teams blatantly chose to ignore the requirements, resulting in costly (tangible and non-tangible) losses. The existing attitude towards compliance was problematic, to the tune of $17.57 MM to the owner company. While the project team knew what needed to be done (based on the original baseline), their refusal to introduce the defined measures obstructed management from knowing the complete scope of work. This, in turn, affected how the performance measurement baselines were assessed and how change was managed, resulting in the minimization of the team’s ability to know what had been done. Having used the assigned project controls personnel, the project teams would have known how actual performance compared to the baseline and checked the results of the corrective actions. This ripple effect impeded the teams’ ability to effectively compare the project’s performance to their respective baselines. The ability to know what work remained to be completed was, therefore, misleading. This inhibited the teams’ ability to identify and implement corrective actions to align performance with expectations. The cumulative effect of the lack of project control efforts and mismanagement contributed to project failure.

Defining and demonstrating project controls’ value may be difficult for some organizations. It is incumbent on the organization to recognize the requirements and minimize these difficulties. The following statements assist an organization in establishing the value that project controls can provide:

- If you can’t define the value, how do you know its worth? Make sure you define the value.

- If people can’t understand the value, why should they care? Make sure you communicate the value.

- If you don’t know where you’re going, how will you get there? Make sure you deliver the value.

- If you can’t prove what you’ve delivered, why should people trust you again? Make sure you measure the value.

In closing, imagine the following: You own a $65,000 vehicle but do not have any insurance on it. Imagine getting in an accident where you are at fault. Imagine having to replace both vehicles, plus pay for a civil lawsuit for personal damages. Imagine if a fatality had occurred. Now imagine if you had bought insurance, where a small investment of $200 a month would have saved you millions of dollars and potential jail time. In terms of the case study, imagine if both development costs/effort and monitoring and controlling costs/effort for both the owner and constructor were applied. Imagine that the organizations introduced effective barriers to minimize project failure. Imagine!

Footnotes:

[i] The post-mortem assessment included an event tree analysis and systems dynamic modeling. System dynamics modeling, introduced in Part 2 of this series of articles (Six Elements of Project Controls— Quality), is a continuous simulation model using hypothesized relations across activities and processes. It can describe ways to assess the degree of the formal process needed to deliver the system (i.e., project controls) with the required level of quality.

[ii] Most, if not all owners, irrespective of their portfolio size, set an upset limit (spend ceiling) for Capex funds to be utilized annually. These limits play a pivotal role in financial management, allowing organizations to regulate their portfolio’s financial debt.

[iii] Business cost overruns go beyond project cost overruns; they define the tangible costs instigated by the cause-and-effect relationships that projects have with the overall organization. Business costs do not include intangible costs, which may include costs to repair the organization’s reputation, strategic endeavors, competition risks, etc.

[iv] A death spiral occurs when an owner organization tries to re-balance its costs (who pays for what). Death spirals are caused by a decrease in revenue and an increase in costs. To offset this, in terms of pipeline providers, rate hikes are introduced. In most circumstances, both the shipper and end customer will pay for this increase. Death spirals can also be caused by the downward demand of products.

[v] A target estimate was established based on the submittal of the competitive bids from five contractors. The target estimate provided a fair and equitable approach to managing the project.

[vi] Systemic risks are uncertainties (threats or opportunities) that are an artifact of an industry, company or project system, culture, strategy, complexity, technology, or similar over-arching characteristics. AACE 10S-90 Cost Engineering Terminology.

[vii] For further understanding of project failure, it is recommended that you read the article TCM.3933 The Project Life Cycle: Preventing Change and Project Failure, AACE Transactions, 2022, H. Lance Stephenson, CCP FAACE.

[viii] Established barriers are key components for defining preventative actions for instituting the Swiss cheese model. The Swiss cheese model is used in risk analysis and risk management as the principle behind layered security. It likens human systems to multiple slices of Swiss cheese, stacked side by side, in which the risk of a threat becoming a reality is mitigated by the differing layers and types of defenses that are “layered” behind each other. In theory, lapses and weaknesses in one defense do not allow a risk to materialize since other defenses also exist to prevent a single point of failure. It is sometimes called the cumulative act effect (Wikipedia).

Rate this post

Click on a star to rate it!

Average rating 4 / 5. Vote count: 4

No votes so far! Be the first to rate this post.

Good morning. I would like to enroll for a project costing course